|

| home |

| how it works |

| who gets it? |

| who pays for it? |

| benefits |

| the SS tax |

| reserve fund |

| FAQs |

|

|

The Old Age, Survivors and Disability Insurance program (OASDI), commonly known as Social Security, is an insurance program run by the U.S. federal government.

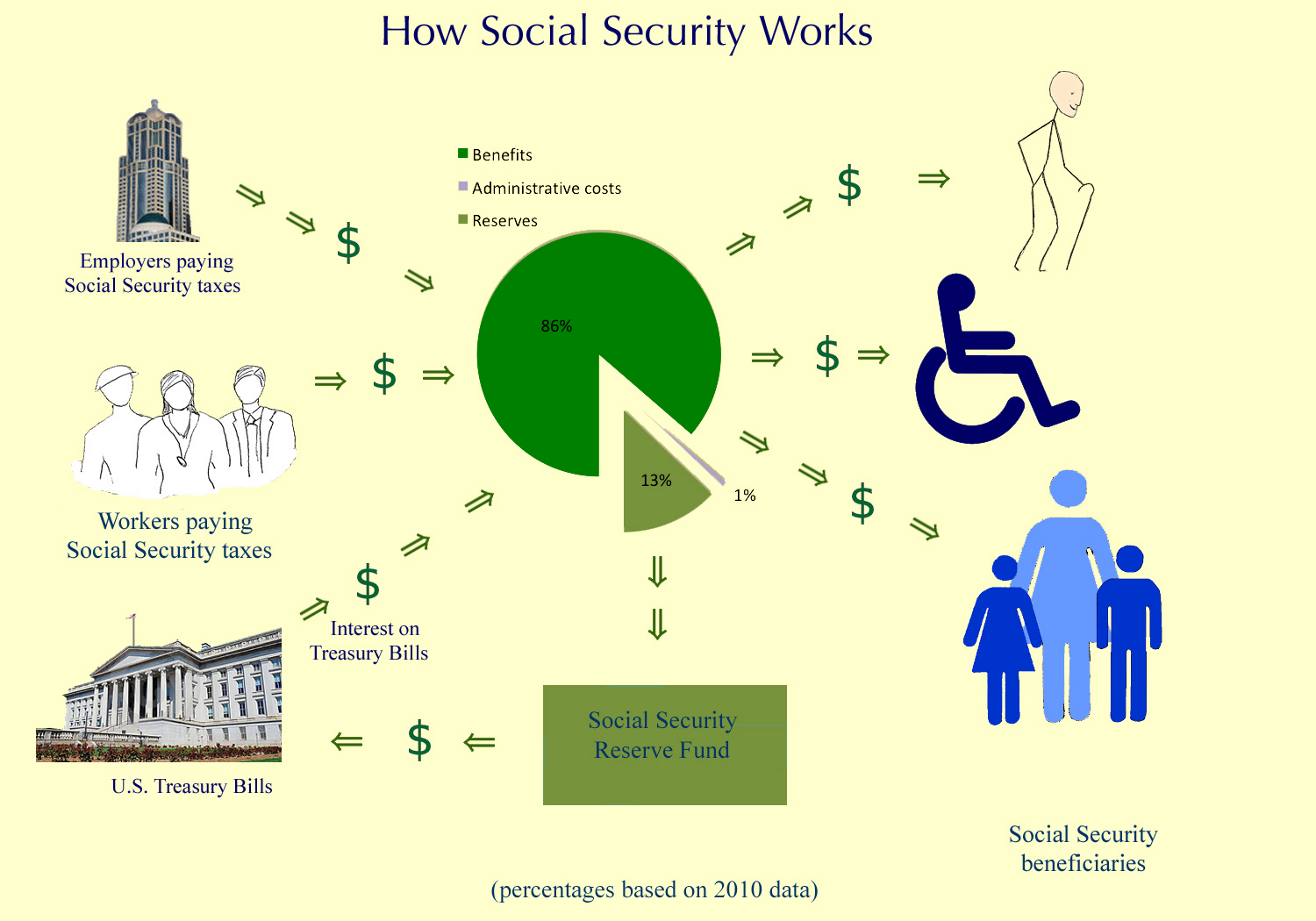

Like all insurance, Social Security works by taking in premiums and paying claims. Premiums are paid by all working people, and a matching amount is paid by their employers. Claims are paid to Social Security beneficiaries (retirees, people on disability, and survivors of deceased workers).

Since the premiums are paid to the federal government, and you are required by law to pay them, they are called TAXES. But they are, in fact, premiums, just like the premiums you pay for homeowners, life or auto insurance.

Also like all insurance programs, Social Security earns a significant amount of money from investments. Social Security's primary source of investment income is its reserve fund.

These reserves are stored in U.S. Treasury bills (commonly called savings bonds). The General Fund of the federal government, therefore, pays interest on these bonds, to Social Security.

Every month, Social Security takes in billions of dollars, from employer and employee taxes, and from interest on its reserves. Most of this money GOES OUT IMMEDIATELY, to pay current beneficiaries. A small amount gets added to the reserve fund. Less than 1% goes to pay the cost of administering the program.

This website presents summary information on Social Security, in a pictorial, easy-to-understand format.

For detailed, official information on Social Security, visit the Social Security website, or contact your local Social Security office or your Congressional representative.

| home | how it works | who gets it? | who pays for it? | benefits | the SS tax| the SS reserve fund | FAQs

© 2012