|

| home |

| how it works |

| who gets it? |

| who pays for it? |

| benefits |

| the SS tax |

| reserve fund |

| FAQs |

|

|

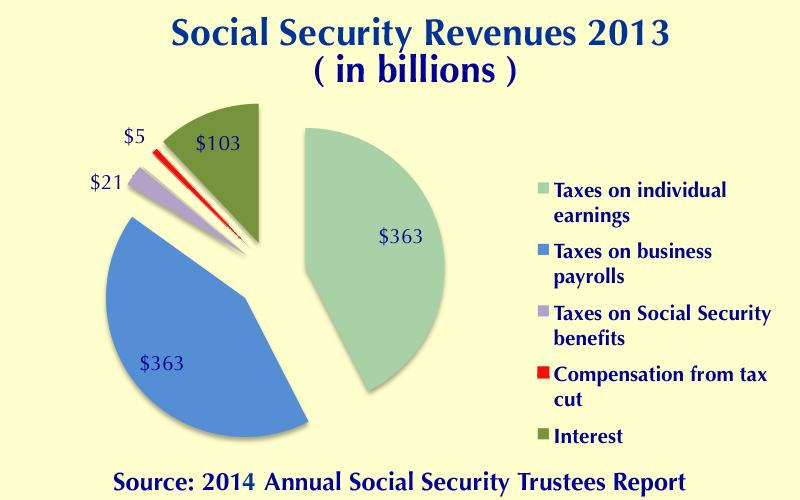

There are four major sources of income to Social Security:In 2013, slightly more than 1% of the workers portion was provided by transfers from the federal general fund, to compensate for the lingering effects of the 2011 and 2012 Social Security tax cuts.

- premium payments from workers

- matching premium payments from employers

- Interest earned on the Social Security Reserve Fund

- federal income tax on Social Security benefits

Social Security income for 2013 totaled approximately $855 billion dollars, distributed as follows:

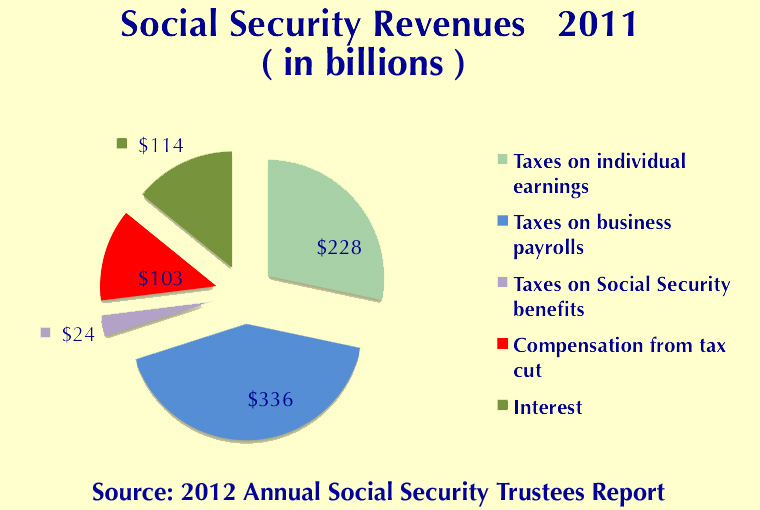

In 2011, approximately 1/3 of the workers portion was provided by

transfers from the federal general fund, to compensate for the

Social Security tax cut.

In 2011, approximately 1/3 of the workers portion was provided by

transfers from the federal general fund, to compensate for the

Social Security tax cut.Social Security income for 2011 totaled approximately $805 billion dollars, distributed as follows:

This website presents summary information on Social Security, in a pictorial, easy-to-understand format.

For detailed, official information on Social Security, visit the Social Security website, or contact your local Social Security office or your Congressional representative.

| home | how it works | who gets it? | who pays for it? | benefits | the SS tax| the SS reserve fund | FAQs