|

| home |

| how it works |

| who gets it? |

| who pays for it? |

| benefits |

| the SS tax |

| reserve fund |

| FAQs |

|

|

The primary source of income for Social Security is the Social Security tax, usually referred to, incorrectly, as the "payroll tax."

The Social Security tax is applied to every employed (and self-employed) person's wages, and is a percentage of those wages. Every employee's contribution is matched by their employer, effectively doubling the amount of tax collected. (Self-employed persons pay both employee and employer portions.)

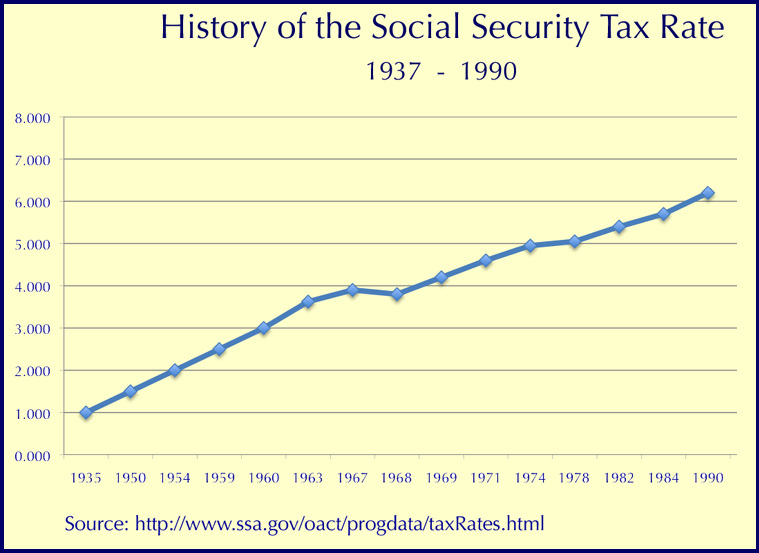

The size of the Social Security tax has varied over the years. The tax started, in 1935, at 1% of taxable wages. It has been raised several times since then (and even decreased, in 1968). The last increase was in 1990, when it was set to 6.2% of taxable wages.

In 2011, approximately 1/3 of the workers' portion was provided by transfers from the federal general fund, to compensate for the Social Security tax cut.

This website presents summary information on Social Security, in a pictorial, easy-to-understand format.

For detailed, official information on Social Security, visit the Social Security website, or contact your local Social Security office or your Congressional representative.

| home | how it works | who gets it? | who pays for it? | benefits | the SS tax| the SS reserve fund | FAQs