|

| home |

| how it works |

| who gets it? |

| who pays for it? |

| benefits |

| the SS tax |

| reserve fund |

| FAQs |

|

|

Every insurance company has a reserve fund, and Social Security is no exception. An insurance reserve fund provides a backup source of money for those times when claims paid out exceed income from premiums and investments.

Social Security's reserve fund is often referred to as the surplus, because it is replenished from the surplus income Social Security has taken in over the last several decades.

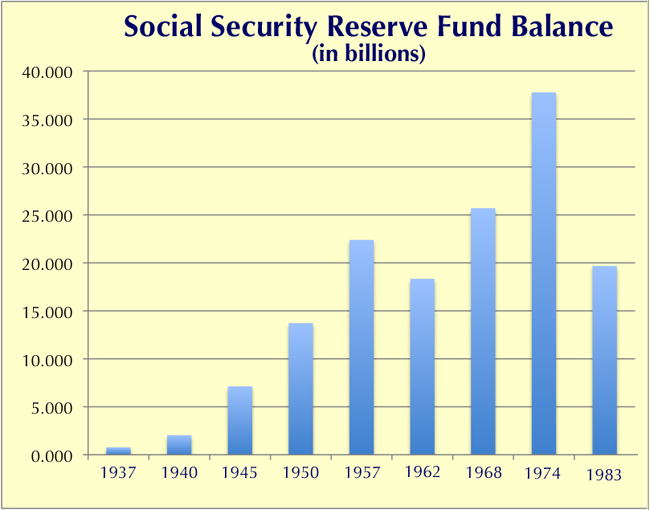

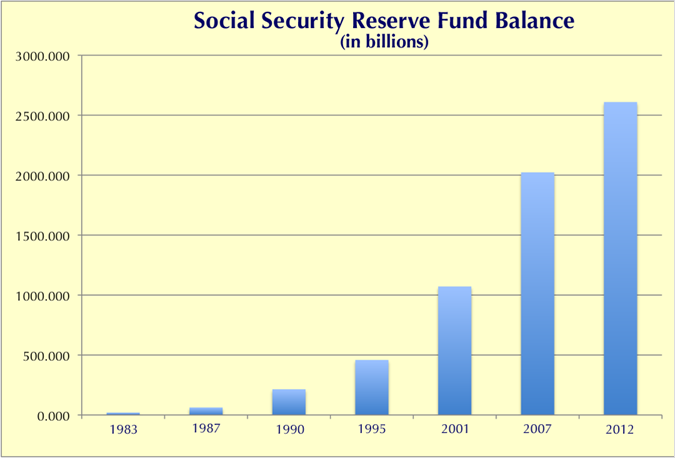

The Social Security Reserve Fund started out, in 1937, with a balance of about $766 million dollars. By 2012, the balance was about $2.6 trillion dollars.

Between 1957 and 1983, Social Security drew on this reserve fund 12 times, in amounts varying from $126 million in 1957 to $4,971 million (4.971 billion) in 1978.

Since Reserve Fund monies are stored (invested) in U.S. Treasury bills, drawing on the Reserve Fund requires the U.S. General Fund to repay some of the principal (not just interest) on these bills.

The following graphs depict the history of the Social Security Reserve Fund balance, over some selected representative years.

The first graph shows the fund fluctuation in the years when it varied between $766 million and about $38 billion.

The second graph shows its fluctuation in the years when it varied between $20 billion and $2.6 trillion.

Source: http://www.ssa.gov/oact/STATS/table4a1.htmlSocial Security has not drawn on its reserve fund since 1983.

This website depicts summary information on Social Security, in a pictorial, easy-to-understand format.

For detailed, official information on Social Security, visit the Social Security website, or contact your local Social Security office or your Congressional representative.

| home | how it works | who gets it? | who pays for it? | benefits | the SS tax| the SS reserve fund | FAQs